Receiving a notice from the Income Tax Department can be stressful. We assist individuals and businesses in understanding the nature of the notice, preparing the required responses, and ensuring timely submission to avoid penalties or legal action.

We provide end-to-end support for filing your income tax returns accurately and on time. Whether you're a salaried employee, freelancer, or business owner, our experts ensure maximum deductions and full legal compliance.

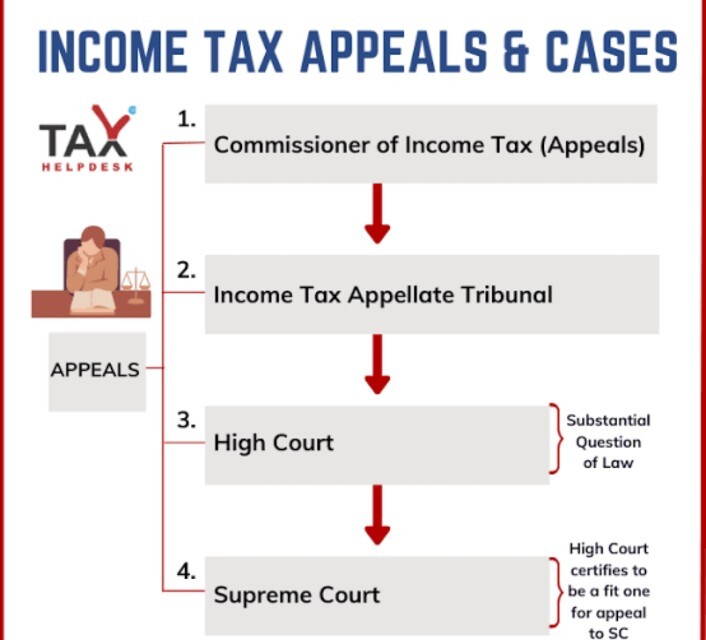

If you’ve received an unfavorable order or penalty from the Income Tax Department, we help you file a structured and legally sound appeal. Our team ensures that your case is properly represented before the tax authorities or tribunal.

We help you interpret and respond to GST notices such as mismatched returns, non-filing, or audits. Our experts ensure timely and compliant resolutions, reducing your risk of penalties or future scrutiny.

Whether you're starting a new business or expanding operations, we offer fast and efficient GST registration services. We handle all the documentation, application process, and follow-up until your GSTIN is issued.

Staying compliant with GST laws is crucial to avoid fines. We manage your invoicing, input tax credit records, monthly and annual returns, and help with audit preparations, ensuring smooth operations.

We ensure timely filing of GSTR-1, GSTR-3B, GSTR-9, and other returns. With regular reconciliation and ITC optimization, we help your business remain compliant and tax-efficient under the GST regime.

We handle corporate tax filings, TDS deductions, advance tax calculations, audit reports, and documentation for your company. Our solutions ensure you stay compliant with the Income Tax Act and related regulations.

We help entrepreneurs register Pvt Ltd, LLP, OPC, or Partnership firms legally and efficiently. Our packages include name approval, DIN/DSC generation, MOA/AOA drafting, and ROC filing.

From legal setup to tax planning and licensing, we provide complete startup support. Our experts guide you through funding readiness, compliance setup, business advisory, and growth strategies.

Our legal team handles civil disputes, criminal defense, property cases, cheque bounce matters, and more. We offer strategic legal solutions and court representation to protect your rights.

Get your partnership firm legally registered with partnership deed drafting, PAN, TAN, and GST registration, along with ongoing compliance support.

We offer formation and registration of charitable trusts, NGOs, and societies under Indian law, including 12A, 80G, and FCRA certifications where applicable.

Stay compliant with ROC filings, board resolutions, annual returns, and other statutory obligations. We manage your company’s secretarial compliance end-to-end.

We help obtain local licenses and establishment certificates required for business setup, including shops and establishment act registration and labor law registrations.

Our services include TDS/TCS return filing, correction statements, and certificate issuance. We help reduce deduction errors and ensure smooth tax credit for payees.

Our advisors help you build a legally strong and financially smart business. From entity structure to funding guidance, we offer long-term strategic advice.

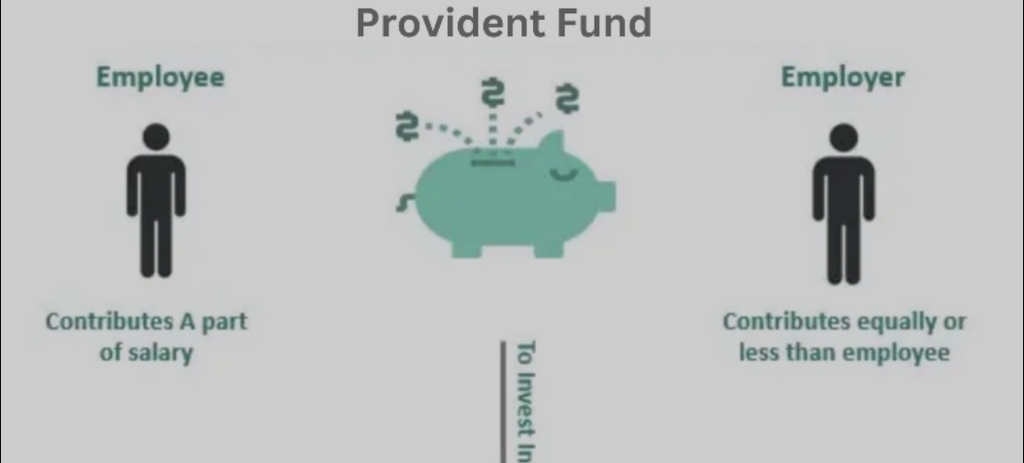

We assist with registration and monthly compliance for PT and PF. This ensures your business meets labor laws and your employees are covered under statutory benefits.

We manage ESI registration and periodic filings, enabling your employees to access medical care and disability benefits as mandated by the ESI Act.

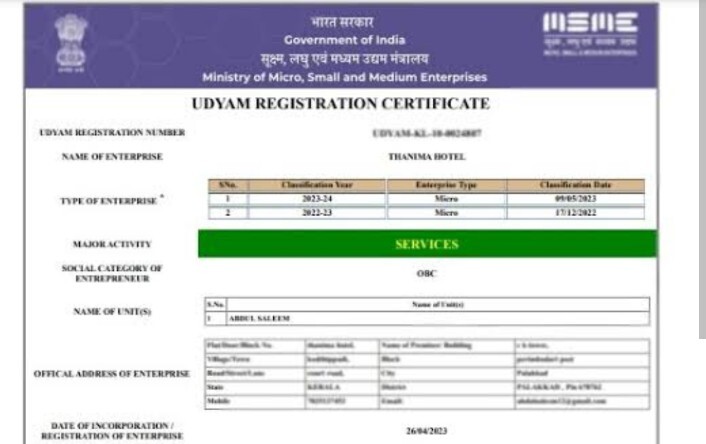

Get your Udyam Registration for government tenders, low-interest loans, subsidies, and other MSME benefits. We offer fast online MSME application services.

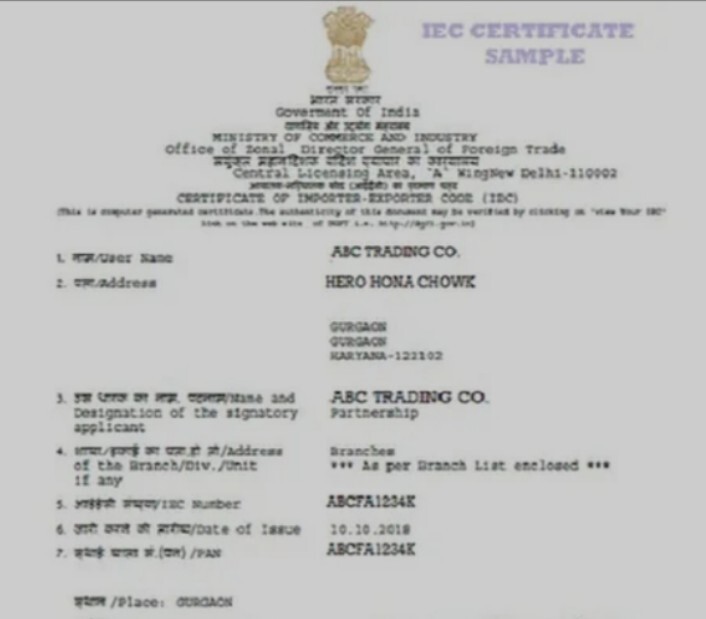

Our team manages the complete process of getting your IEC, enabling you to import and export legally under DGFT guidelines. Required for international trade.

By accessing and using www.jurisedgelegalpartners.in, you acknowledge that you have read, understood, and agree to be bound by the terms and conditions contained herein.

The Advocates Act, 1961 restricts advertising by advocates in India. You confirm your visit to this website is voluntary, and no solicitation was made by us. Our website serves only as a source of general information regarding the legal services we provide.

This website does not intend to solicit or advertise legal services to the public. The content available on this site is meant for informational purposes only and does not constitute legal advice.

You confirm that by accessing this website, you do so on your own accord, and we have not in any manner solicited your attention to visit our website.